NBC Nears Super Sellout at $3.5 Million Per Spot

As the NFL gets ready to kick off a new season on Sept. 8, NBC Sports says it is already nearing the goal line in selling out commercials during Super Bowl XLVI next Feb. 5.

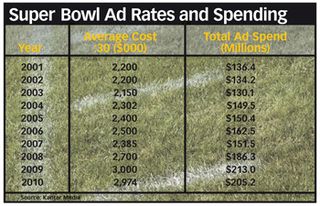

Seth Winter, senior VP, NBC Sports Group Sales & Marketing, says NBC has only a handful of units left in the big game, and adds the network is in "active conversations" on the remaining units. Pricing is way up, about $3.5 million for 30 seconds, according to Winter, which is a record-setting number, up significantly from the $3 million Fox got last February as the Green Bay Packers beat the Pittsburgh Steelers.

The Super Bowl is TV's most viewed event each year. And while advertisers pay big bucks to take part, it is often seen as one of the best media deals because of its huge reach and an audience that is nearly as engaged in the commercials as it is in the game.

"What people have recognized is, the value of the Super Bowl is exponentially greater now with the employment of social media and social TV," says Winter. "People activate their sponsorships in the Super Bowl weeks out, sometimes weeks after. Now it's not just buying a unit. Now it's buying a unit and planning in and around the activation of the unit."

NBC's early sales show that demand for the NFL was not affected by the lockout, which threatened the season until an agreement between the team owners and the players was ironed out just in time for almost all of the scheduled preseason games to be played. Winter also says sports have been largely impervious to the economic alarm bells that have slammed the stock market.

But some buyers say that while NBC was able to get spots sold very early at the price it was asking, even the sports market has cooled a bit, and that selling those last few Super Bowl spots could take some effort. "If you'd have asked four months ago, I'd have said they'd be done in June, beating last year when Fox was sold out in October," says one large agency buyer. "Now, it's not over till it's over."

NBC is also filling up its Super Sunday pregame advertising, where ads are more affordable and sponsorship rules are looser than those imposed by the NFL during games.

Winter wouldn't name the Super Bowl sponsors, but Anheuser-Busch (now the official brewer of the NFL), Pepsi (which will feature the winner of Fox's The X Factor in one spot) and Century 21 have already been identified as having bought Super spots. In addition, cars have been "exceptionally strong," along with soft drinks, malt beverages and movies.

NBC Sports doesn't sell Super Bowl spots on a stand-alone basis; it sells them in packages. In addition to Super Bowl pregame and NFL regular-season spots, many packages include the 2012 London Olympics. "Our Super Bowl conversations started right around this time last year, as we were bringing the Olympics into the marketplace," Winter says.

Another NBC Sports priority in creating packages has been selling its added hockey inventory, available thanks to a newly expanded arrangement with the National Hockey League.

Winter says most NBC Sports' properties fit well in packages because the NHL, Notre Dame football, golf and French Open tennis all reach upscale audiences.

While NBC Sports scores with the Super Bowl, the NFL regular season's Sunday Night Football sold well also, generating big price increases despite the lockout. After selling about 90% of its inventory in the upfront, NBC is selling the rest in the fourth-quarter scatter market, which started a week or two ago.

Winter says the strength of the NFL never ceases to amaze him. "It's like scaling Kilimanjaro," he says. "You think you're at the peak and then you look up and there's another peak."

Neil Mulcahy, executive VP, Fox Sports sales, says Fox has been getting double-digit increases for its Sunday NFL games. "The preseason was not as strong because that was one area where people were unsure to place their bets, but because people stepped up and bought the regular season, we're certainly in a great position," Mulcahy says. "We've written more business than we had last year at this point."

Mulcahy says the auto category has been strong, along with credit cards, wireless and beer.

At ESPN, the strength of the NFL is not only selling commercials in Monday Night Football, but in generating ad dollars in other NFL-related programming, both on TV and online. "Our pregame shows, SportsCenter around NFL programming, our NFL Live, all of those properties are doing extraordinarily well," says Ed Erhardt, president of customer marketing and sales at ESPN.

Erhardt adds that ESPN.com Fantasy Football is sold out, and the company's other digital businesses are pacing ahead of last year. Even print is hot, with the college and NFL preview issues of ESPN The Magazine among the largest ever. "We benefit from a strong NFL market in a lot of different ways, as opposed to just the game unit," Erhardt says.

Despite the economic concern, Fox's Mulcahy expects the football market to stay healthy. "It's kind of weird when you look at all you read [about unemployment and Wall Street], but I guess as long as people have products they need to sell and need to get the word out, we're the best medium."

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.