Making Older Viewers Count

At a time when TV networks are working increasingly hard to monetize viewers watching on alternative platforms, there are signs that marketers are paying for eyeballs belonging to viewers age 55 and older.

With five months to go before the upfront, networks are already lobbying to change the currency used for media buying from C3 commercial ratings to C7 commercial ratings, which would increase the number of viewers counted by including delayed viewing on DVRs for seven days after airing, up from the current three days.

It remains to be seen how successful the networks will be in convincing their clients to embrace C7 ratings. But marketers increasingly appear to be paying for viewers outside the demographics long favored by buyers.

In a presentation at an investors' conference earlier this month, David Poltrack, chief research officer at CBS, the network with the largest number of older viewers, said those viewers are being reflected in the prices paid for advertising.

CBS has long railed against the advertising industry's fascination with targeting younger viewers. At the B&C/Multichannel News OnScreen Summit on Dec. 6, CBS CEO Les Moonves said the 18-49 demo was "bulls--t," and quipped that the only affluent 18-34 year-olds are his children. NBC has also been highlighting the consumption pattern of the aging baby boomers, which it labels "Alpha Boomers."

Now, instead of relying on the traditional age-based 18-49 and 25-54 demographics for targeting consumers, "new research initiatives have introduced advanced metrics that provide far more precise segmentation of television audiences to marketers," Poltrack said. In addition, new single-source measurement services now allow advertisers to measure the actual purchase activity of television audiences in their product categories.

"The challenge now is to reconcile these new, sophisticated media planning measures with the less precise age-based currency measures used in the media buying process," Poltrack added.

Those new measurements can make older-skewing shows appear more attractive to marketers. For example, the CBS series Blue Bloods has a relatively low concentration of the 18-49 year-olds soft drink marketers usually target. But using advanced metrics, Poltrack said, it turns out that Blue Bloods has a higher concentration of heavy soft drink consumers. And given a relatively low CPM, suddenly the show appears to be an efficient buy if you're a soft drink maker.

More and more marketers are looking at these advanced metrics, and that's starting to affect the programs they choose to buy. The added demand for shows with older viewers is raising advertising unit prices.

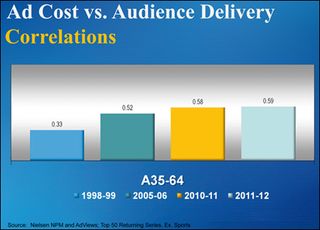

Poltrack said proof that the typical media planning and buying practice in television advertising "is moving away from age and gender alone to these more sophisticated and more accountable metrics" is shown by a decreasing correlation between ad prices and 18- 49 delivery and an increasing correlation between prices and 35-64 delivery.

"The correlation, though still very strong, is beginning to come down," Poltrack said. Using price data from Nielsen, Poltrack said the correlation with 18-49 delivery has fallen from 91% in the 2009-10 season to 85% in 2011-12."

"More telling is a longer-term relationship between unit prices and adults 35-64," Poltrack said. "This is where the key baby boomer segment of the population has moved, and it is clear that marketers are continuing to keep this key purchase group in their target." That correlation was 52% in 2005-06 and rose to 59% in 2011-12.

Buyers aren't basing their transactions on adults 35-64, but the figures confirm "they are making changes in their media selection process that place a higher value on programs that deliver this key segment," Poltrack said.

"One of the factors causing this rise in the correlation of adults 35-64 ratings with price is the fact that in the most recent years, CBS, the dominant network with viewers in this older age group, has become the leading network in adults 18-49 as well," he added.

Media buyers have been reluctant to change the way they do business, and it is unclear whether they would ever target an older demographic group.

At the B&C/MCN OnScreen Summit, Irwin Gotlieb, the media buying oracle who runs GroupM, which is among the larger media investment fi rms, said targeting 18-49 year-olds still has merit because while other consumers aspire to be older or younger, 18- 49 year-olds are the most comfortable in their own skins. But the game will change when TV becomes a more addressable medium.

"Addressable ads will be far more effective because of targeting, more relevant, more engaging," Gotlieb said. He sees addressable ads starting small, then scaling up over the next two to three years.

"There are really astounding possibilities for TV ad growth," he added.

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.